You can even produce and print a loan amortization timetable to discover how your month-to-month payment will pay-off the loan principal plus interest over the system in the loan.

three. Reasonably envisioned income. If a creditor relies on anticipated money in excess of the consumer's revenue, both in addition to or as opposed to present-day earnings, the expectation that the cash flow are going to be readily available for repayment needs to be affordable and verified with third-social gathering data that provide fairly reputable evidence of The buyer's anticipated earnings. As an example, If your creditor relies on an expectation that a buyer will obtain an yearly reward, the creditor may possibly confirm the basis for that expectation with documents that present The buyer's past once-a-year bonuses, as well as envisioned reward ought to bear an affordable romantic relationship on the past bonuses.

seven. Illustrations. The subsequent are examples of how to find out the periodic payment of principal and desire depending on the utmost curiosity price in the 1st 5 years following the date on which the main normal periodic payment will probably be due for reasons of Assembly the definition of skilled mortgage under § 1026.

i. Initial, the creditor must identify the “tier” into which the loan falls depending on the loan total. The loan amount of money may be the principal volume The customer will borrow, as reflected inside the promissory Take note or loan agreement. See

In some cases a creditor sets the curiosity fee initially then re-sets it at another stage before consummation. The creditor should use the last date the interest level is about just before consummation.

ii. Next, the calculation has to be based on significantly equivalent month to month payments of principal and desire which will thoroughly repay the utmost loan amount in excess of the expression in the loan remaining as of the date the loan is recast.

(D) Momentary payment accommodation in connection with a disaster or pandemic-similar countrywide emergency usually means short term payment reduction granted into a client as a result of fiscal hardship triggered specifically or indirectly by a presidentially declared crisis or important catastrophe beneath the Robert T. Stafford Catastrophe Relief and Emergency Assistance Act (forty two U.S.C. 5121 et seq.

5. The creditor disregarded evidence that The buyer could possibly have insufficient residual profits to cover other recurring obligations and bills, taking into account The buyer's assets aside from the residence securing the loan, after having to pay their regular payments for that included transaction, any simultaneous loans, home loan-associated obligations, and any recent credit card debt obligations; or

(iv) The balloon-payment qualified mortgage loan is sold, assigned, read more or normally transferred pursuant to a merger of your creditor with A different particular person or acquisition with the creditor by another individual or of A further man or woman because of the creditor.

Wherever a variety for the utmost fascination level throughout the 1st five years is presented, the very best rate in that range is the most desire amount for uses of § 1026.43(e)(2)(iv). Exactly where the terms of your authorized obligation are usually not determined by an index in addition margin or method, the creditor need to use the maximum desire fee that occurs during the to start with five years once the date on which the very first frequent periodic payment is going to be because of. For instance:

You may realize that getting out a $forty,000 own loan isn’t in your very best desire. If so, here are some choices to take into consideration which could work much better for you personally:

So, the creditor need not enter right into a independent arrangement with the home loan broker with respect to each coated transaction which has a prepayment penalty.

i. First, the payment have to be based on the fantastic principal equilibrium as from the date on which the home finance loan is recast, assuming all scheduled payments are actually created around that date and the last payment owing underneath These terms is made and credited on that date. As an example, suppose an adjustable-amount property finance loan with a thirty-yr loan phrase. The loan arrangement offers that the payments for the very first 24 months are depending on a fixed price, and then the desire level will regulate annually based on a specified index and margin.

1. Factors and costs. Whether or not an alternative protected transaction without a prepayment penalty satisfies the factors and charges disorders for a qualified home loan is set dependant on the information identified to your creditor at some time the creditor provides The buyer the transaction. At enough time a creditor provides a client another included transaction with no prepayment penalty beneath § 1026.43(g)(3), the creditor may well know the level of some, although not all, with the details and costs that should be billed with the transaction.

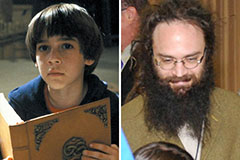

Barret Oliver Then & Now!

Barret Oliver Then & Now! Ben Savage Then & Now!

Ben Savage Then & Now! Judge Reinhold Then & Now!

Judge Reinhold Then & Now! Sam Woods Then & Now!

Sam Woods Then & Now! Kelly Le Brock Then & Now!

Kelly Le Brock Then & Now!